Why Comparing Private Health Insurance (PKV) Matters in 2025

Germany’s healthcare system is built on two pillars: statutory health insurance (GKV) and private health insurance (PKV). While GKV offers broad, standardized coverage, PKV allows for customized benefits and faster access — but at the cost of complexity.

With more than 8 million people insured privately in Germany, choosing the right PKV plan requires careful comparison. Policies differ not just in price but also in tariff level, reimbursement rules, waiting periods, and long-term affordability.

The Basics: How PKV Tariffs Work

Every private health insurer in Germany offers tariffs (plans), which determine coverage scope and monthly premium. Unlike GKV, PKV pricing depends on:

- Age at entry (younger = lower premiums).

- Health status (pre-existing conditions can mean exclusions or surcharges).

- Chosen tariff tier (basic, comfort, premium).

- Deductible (Selbstbeteiligung) — higher deductibles = lower premiums.

Premiums also include Altersrückstellungen (age reserves), a savings component meant to stabilize costs as you grow older.

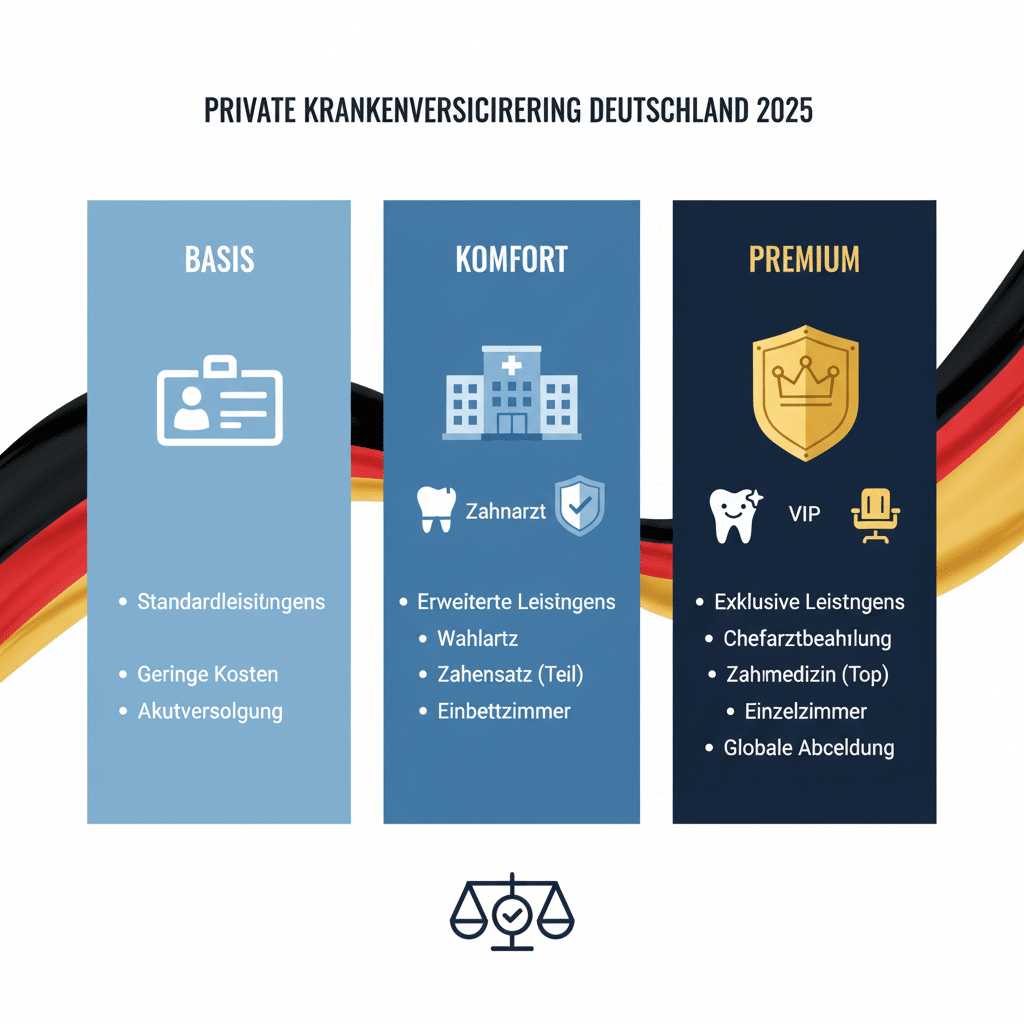

Tariff Levels Explained: Basic vs. Comfort vs. Premium

1. Basic Tariffs

- Coverage similar to GKV.

- Lower monthly cost.

- Limited access to private clinics or advanced treatments.

- Often used by those who only need minimum required cover.

2. Comfort Tariffs

- Balanced option, most popular for freelancers and employees.

- Includes extras like single/double hospital room, specialist choice, or better dental coverage.

- More flexible reimbursement rules.

3. Premium Tariffs

- Comprehensive “all-inclusive” coverage.

- Worldwide coverage, private clinics, top-tier dental, alternative treatments.

- Highest premiums, best suited for high-income earners who value maximum comfort.

Key Features to Compare When Choosing PKV

When doing a PKV Vergleich (comparison) in 2025, don’t just look at the monthly premium. Evaluate:

- Coverage scope – outpatient, inpatient, dental, preventive care.

- Waiting periods – some services (e.g., dental, maternity) may have initial waiting times.

- Reimbursement rules – do you pay upfront and claim, or is it billed directly?

- Deductible (Selbstbeteiligung) – annual out-of-pocket limit.

- Optional add-ons (Zusatzbausteine) – dental riders (Zahnzusatz), daily sickness allowance.

- Beitragsentlastungstarif – extra contribution now to reduce premiums after retirement.

- Service & support in English – important for expats.

How PKV Premiums Are Calculated

Unlike GKV, where contributions are a % of income, PKV premiums depend on:

- Age at joining → Joining at 25 vs. 40 can mean hundreds of euros difference.

- Health check results → Non-smokers with no chronic conditions get lower rates.

- Tariff tier chosen → Comfort vs premium makes a large impact.

- Deductible level → Higher deductibles reduce monthly costs.

💡 Example: A 30-year-old healthy freelancer might pay €350–€450/month for comfort coverage, while a 45-year-old could face €600+.

Top Private Health Insurance Providers in Germany (2025)

Several insurers consistently rank well in independent Stiftung Warentest and Morgen & Morgen ratings:

- Allianz – strong premium tariffs, global coverage.

- Debeka – competitive for civil servants (Beamte).

- Hallesche – good mix of affordable and comfort tariffs.

- ARAG – flexible modular tariffs, good dental options.

- Gothaer – strong in supplementary riders.

PKV vs GKV: Switching Rules

- Eligibility for PKV: Employees must earn above the annual income threshold (Beitragsbemessungsgrenze: €69,300 gross in 2025). Self-employed and freelancers can opt in regardless of income.

- Returning to GKV: Possible under strict conditions (e.g., job loss, income drop). After age 55, switching back is usually impossible.

Questions to Ask Before Signing a PKV Contract

- What is included in outpatient, inpatient, and dental coverage?

- Are there waiting periods for maternity or dental treatment?

- How much will my deductible be?

- Can premiums be reduced in retirement (Beitragsentlastung)?

- What happens if my income drops in the future?

- Is English-language support available?

- How stable has this insurer kept premiums in the past?

Common FAQs

1. What’s the difference between Basic/Comfort/Premium PKV tariffs?

Basic = minimal cover, Comfort = balanced, Premium = full luxury cover.

2. Can I switch back to GKV after joining PKV?

In most cases, only if you’re under 55 and meet income/employment criteria.

3. How do reimbursements work with PKV?

You usually pay the doctor bill upfront, submit it to your insurer, and get reimbursed. Some insurers handle direct billing.

4. How do PKV premiums change with age?

They increase gradually, but age reserves (Altersrückstellungen) help stabilize costs long term.

5. Which PKV is best for expats?

Insurers like Allianz, ARAG, and Hallesche offer English service and flexible tariffs for expats.

Final Checklist Before Choosing PKV

✅ Compare tariffs across at least 3 providers (Basic vs Comfort vs Premium).

✅ Consider long-term affordability, not just today’s premium.

✅ Ask about waiting periods, deductibles, and retirement discounts.

✅ Check whether your insurer offers English support (important for expats).

✅ Use comparison tools (PKV Vergleich 2025) and consult an independent broker if unsure.

👉 Bottom line: Private health insurance in Germany offers flexibility and premium healthcare access — but it’s a long-term financial commitment. Taking the time to compare tariffs, providers, and features in detail will save you from costly surprises later.

One thought on “Comparing Private Health Insurance Plans in Germany (2025): What You Need to Know Before Deciding”